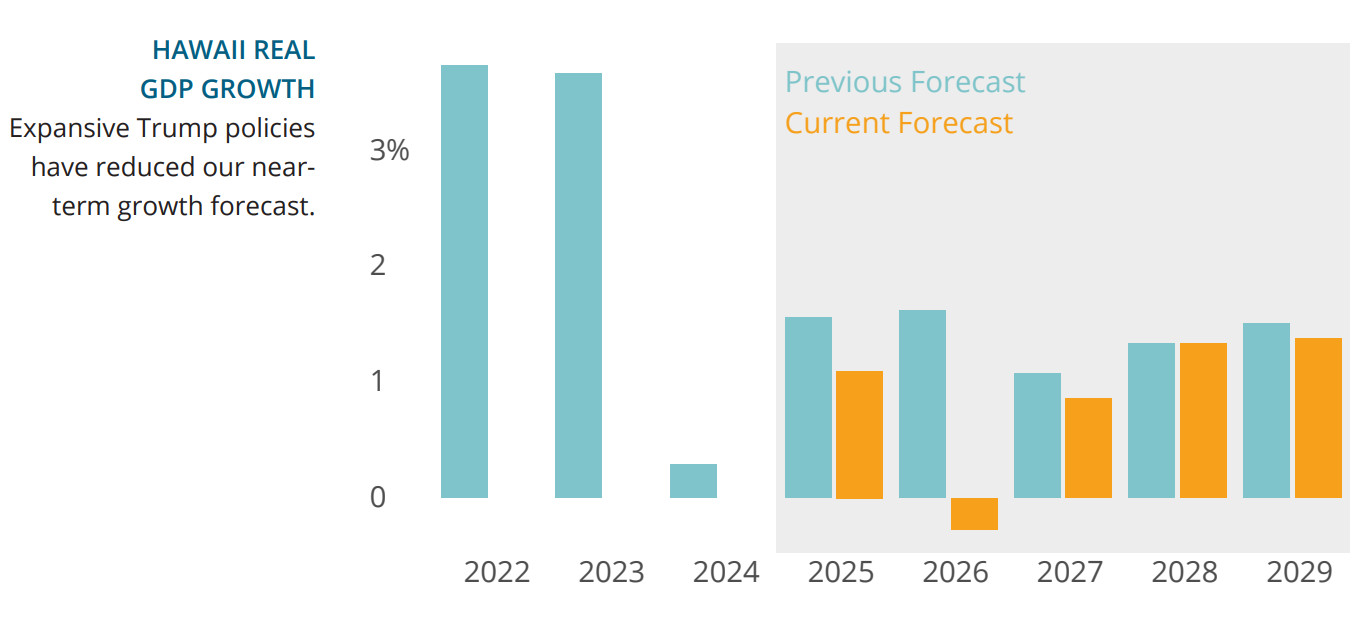

(BIVN) – Hawaiʻi could be headed towards a mild recession due to expansive federal policy shifts.

According to the University of Hawaiʻi Economic Research Organization (UHERO) second quarter forecast for 2025, Hawaii’s economic outlook “has taken a decisive turn for the worse”, as a result of sharp increases in U.S. import tariffs, sweeping federal layoffs, and volatile fiscal and immigration policies. UHERO says the federal policies “are undermining consumer confidence, raising inflation expectations, and worsening the business outlook — both nationally and in Hawaiʻi’s visitor-dependent economy.”

Along with its second quarter forecast, UHERO posted a video summary of the economic outlook on its YouTube channel.

UHERO Focus: 2025 Q2 Forecast, video by UHERO via YouTube

The UHERO news release concerning the forecast focused on several points:

National and global context

The Trump administration’s imposition of the highest import tariffs in more than a century—including a universal 10% tariff and levies as high as 145% on some Chinese goods—has destabilized U.S. markets. Equity indices plunged in response, and both business and consumer sentiment has declined sharply. With federal layoffs now exceeding 130,000 and at least another 140,000 planned, labor market weakness looms. Because of the inflationary impact of tariffs, the Federal Reserve is likely to delay interest rate cuts, barring a marked economic slowdown. U.S. GDP is now forecast to grow less than 1% this year, while global growth projections have been revised downward across most economies, including in the key visitor markets of Canada and Japan.

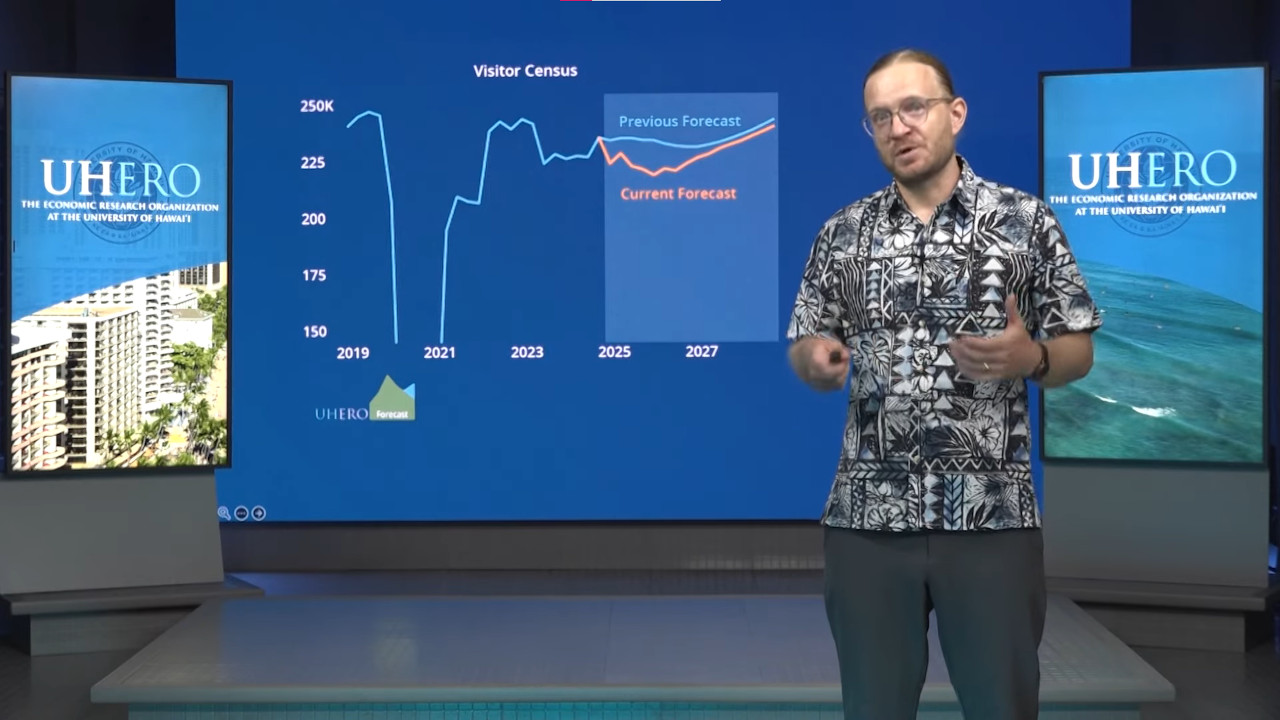

Hawaiʻi tourism outlook

Although the year began with modest gains—particularly on Maui, which benefited from post wildfire recovery—Hawaiʻi’s tourism sector now faces significant headwinds. International arrivals are already down 3–6%, with double-digit percentage declines in airlift from Japan and Canada. A soft booking trend and still-weak currencies suggest a deepening slump in international travel. Domestically, economic uncertainty and higher costs are expected to dampen demand. Total visitor arrivals are now projected to decline by 4% over the next two years, with a $1.6 billion reduction in real visitor spending by 2026. All counties will see declines in visitor-related employment. A full recovery of visitor arrivals is not expected until 2028.

Labor market and inflation

Job growth began the year on solid footing, but momentum will fade. The forecast anticipates a nearly 1% contraction in employment for 2026, with the biggest losses in public sector and visitor-related jobs. Federal spending cuts may ultimately reduce Hawaiʻi’s federal workforce by 2,300 civilian positions, and spending cuts will reverberate through local government and nonprofit sectors dependent on federal funding. Tariffs will drive an increase in inflation, with the Honolulu CPI forecast to exceed 4% in 2025 and 2026, up from earlier projections.

Construction and housing

Construction remains strong for now, buoyed by public infrastructure and Maui rebuilding, but tariffs on imported materials and labor constraints will weigh on future activity. By 2027, construction employment will begin to gradually recede. Housing prices remain elevated, with median single-family home prices continuing to rise. Condominium markets, especially in Maui, are stagnating due to the ongoing insurance crisis and potential regulatory changes such as the “Minatoya List” vacation rental phase-out.

Local policy impacts

Federal budget decisions continue to inject uncertainty into Hawaiʻi’s funding landscape. Potential cuts to Medicaid and SNAP could affect hundreds of thousands of residents. At the state level, initiatives such as a proposed “green fee” via a Transient Accommodations Tax hike aim to fund climate and economic development efforts, but timing and impact remain uncertain.

Forecast risks

UHERO now forecasts limited GDP growth for 2025 and a contraction in 2026, marking Hawaiʻi’s first recession since the pandemic. Recovery will be slow, with real income growth remaining below 1% until 2028. Risks remain exceptionally large: sustained tariffs, delayed policy reversals, and global backlash to U.S. actions could deepen the downturn. While fiscal stimulus and currency shifts may offer partial relief, the near-term outlook is marked by uncertainty, fragility and broad-based economic stress.

by Big Island Video News5:38 pm

on at

STORY SUMMARY

HONOLULU - The University of Hawaiʻi Economic Research Organization says federal policy shifts are likely to tip the local economy into a mild recession.