The following is the full text of Mayor Harry Kim’s budget message to the Hawaiʻi County Council.

Aloha Council Members:

As required by the Hawai‘i County Charter, submitted with this message is the proposed operating budget for the County of Hawai‘i for the fiscal year ending June 30, 2021. This balanced budget includes estimated revenues and appropriations of $625,941,676, and includes the operations of thirteen of the County’s special funds as well as the General Fund.

This proposed FY 2020-21 budget is $40,499,529 or 6.9 percent larger than the FY 2019-20 budget. This budget reflects $13.5 million in additional salaries, wages and employee benefit expenses. Fringe benefit increases were a result of higher retirement contributions and post-employment benefits. Increased salaries and wages are primarily a result of collective bargaining. Also reflected in the budget is an additional $18 million for capital projects and debt service for transportation related projects.

REVENUE

Real property tax revenue is expected to increase by $12.8 million or 3.9 percent. The general excise tax surcharge is expected to generate an additional $18 million as the current rate will be in effect for the entire fiscal year. The increases in sewer fees and tipping fees will generate an additional $2.7 million in the coming year. Intergovernmental revenue will increase by $2.3 million. All of these increases are essential to providing services to our community.

EXPENDITURES

Some of the largest expenditure increases were related to salaries and wages and fringe benefits. Our contribution to the Employees’ Retirement System is expected to increase by $7.8 million due to the increase in rates passed by the Legislature in 2017 and the increase in salaries and wages. This is the final scheduled employer retirement contribution increase. The ERS rates were increased for the coming year by 14% for police and fire employees and by 9% for general employees. The retirement contribution rates have increased 64% for police and fire employees and by 41% for our general employees over the last four years.

A continued priority this year is to address our transportation system. More funding is available for roads, bridges and transit related projects. We realize that transportation is a critical factor in helping our community. Many of our roads and bridges are in need of repair and the available funding will be a significant help in getting many of our roads and bridges repaired. The funding will also be used to continue implementation of the Mass Transit master plan.

IMPACT

The revenue increases made in previous years have allowed us to have adequate funding to continue our programs and continue to provide critical services to our community. However, many departmental needs that would allow us to better service our community went unmet due to insufficient funding. We will continue to look at these needs as we finalize the budget in May.

The budget should contain what is needed to help the people of our County and provide necessary services. The budget should be based on our objectives to provide quality service to the public, while maintaining prudent and conservative spending. This budget still does not include everything needed, but it does go a long way towards providing the services required by our community.

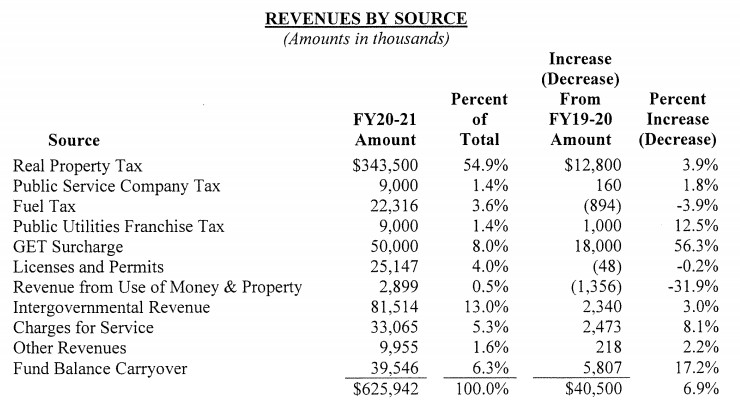

OPERATING BUDGET BY FUND

The following table describes the budgeted expenditures for FY 2019-20 and the proposed budget for FY 2020-21 for each fund:

REVENUES BY SOURCE

The following table presents a summary of projected FY 2020-21 revenues from various sources and the changes from the current budget:

REVENUE CHANGES

The major changes in projected revenues are as follows:

Real Property Tax. Real property tax revenues are expected to increase by 3.9%, or $12.8 million, primarily due to new construction and an increase in taxable values.

General Excise Tax Surcharge. General excise tax surcharge is expected to increase by $18 million or 56.3% in the coming year. This is the first full year of revenues from the 4% surcharge.

Intergovernmental Revenue. Increases in grant revenues of about $2.3 million reflect those grants we are aware of at this time.

Charges for Service. Charges for services is expected to increase by $2.5 million primarily due to the increases in sewer charges and tipping fees.

Fund Balance Carryover. This budget reflects $5.8 million more in carryover savings from the current year operations of all funds.

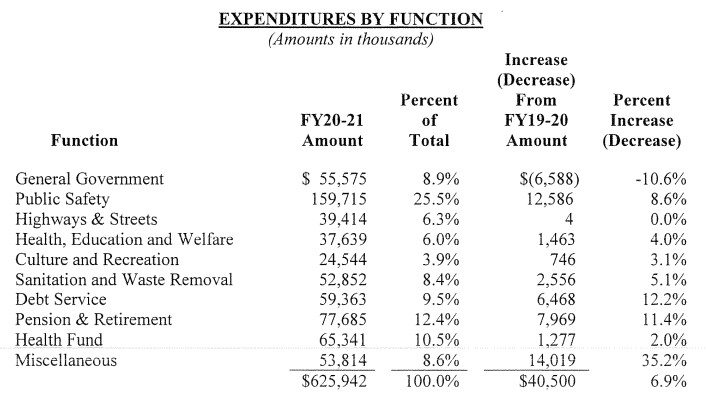

EXPENDITURES BY FUNCTION

The following table presents a summary of projected FY 2020-21 expenditures from various sources and the changes from the current budget:

EXPENDITURE CHANGES

Increases in salary and wages due to collective bargaining are reflected in all functional areas of county government. For collective bargaining increases that have not been finalized, the increases were included in the provision for compensation adjustment. Overtime is reflected in each department’s salaries and wages, whereas it was included in the Finance Department in the current fiscal year.

Other major changes in projected expenditures not explained above are as follows:

Health, Education and Welfare

- Non Profit Grants. Additional grant funding for nonprofits of $1 million was included as required by the County Code.

Sanitation and Waste Removal

- Solid Waste. Funding for solid waste increased by approximately $1.7 million primarily related to the costs associated with disposing of waste at the West Hawaii Sanitary Landfill at Pu‘uanahulu since the South Hilo Sanitary Landfill has closed. The increases include contractual obligations related to the increased tonnage, lease of equipment, fuel and repairs and maintenance costs.

Debt Service

- Transfer to Debt Service. Debt service increased $6.5 million or 12.2% due to the increase in State Revolving Fund loans for upcoming sewer and solid waste projects, as well as, the increase for new bonds to be issued for projects already in progress, as well as expected new projects.

Pension & Retirement

- Retirement Benefits. Pension and retirement payments will increase by approximately $8.0 million, or 11.4%, primarily due to an increase in contributions to the employee retirement system for rate increases established by the State Legislature and the increase in salaries and wages.

Health Fund

- Post-employment Benefits. Contributions to the Employer Union Trust Fund for other post-employment benefits are required by state law. This amount will increase by $1.4 million, or 3.4%, due primarily to the increase in the Annual Required Contribution (ARC) per the actuarial report.

Miscellaneous

- Transfer to Capital Projects Fund. Transfer to Capital Projects Fund increased by approximately $13.4 million in the General Excise Tax Fund for transit and road projects to improve the transportation system on our island.

- Miscellaneous Insurance Claims and Judgments. The account was increased by $2.25 million to cover anticipated claims in the coming year.

- Provision for Compensation Adjustments. The account was decreased by $2.1 million to reflect the collective bargaining unit increases that have not yet been finalized.

CONCLUSION

This proposed budget represents our departments’ best efforts to meet the needs of our residents in a timely and responsible fashion, while striving to maintain the level of services our residents deserve. We are committed to continuing our investment in infrastructure, transportation, public safety, and creating safer communities.

These investments are critical to the future of our Hawai‘i Island. We look forward to working closely with the Hawai‘i County Council as we prepare a responsible budget to meet the needs of those that we serve.

Aloha,

Harry Kim

Mayor

by Big Island Video News12:25 pm

on at

STORY SUMMARY

HAWAIʻI COUNTY - The proposed budget is 6.9 percent larger than the last year's budget,and includes estimated revenues and appropriations of $625,941,676.