(BIVN) – As foreshadowed in his May 1st letter to state lawmakers, Mayor Harry Kim will be looking to raise taxes in order to balance the county budget.

The mayor’s revised budget plan was confirmed in detail in his May 5 message to the Hawaii County Council.

A 6.5% property tax increase is being proposed on all classes except affordable rentals, as well as a fuel tax rate increase. The fuel tax increases will be staggered over a three year period, ending up at 23¢ cents per gallon by Fiscal Year 2019-2020, up from the current county rate of 8.8¢ per gallon.

Although the tax increases weren’t included in the mayor’s preliminary budget proposal, a lot has changed since then. Five of eight collective bargaining unit agreements have been reached resulting in salary and wage increases of approximately $8.3 million. Health benefits that were expected to increase by 6% actually increased by 10%, the mayor says. Also, the county’s share of the Transient Accommodations Tax was reduced by the state legislature. The legislative session ended on May 4.

Details are found in the letter to the council, reproduced here:

Aloha Council Members,

As required by the Hawai‘i County Charter, submitted with this message is the proposed operating budget for the County of Hawai‘i for the fiscal year ending June 30, 2018. This balanced budget includes estimated revenues and appropriations of $491,24l,880, and includes the operations of eleven of the county’s special funds as well as the general fund.

This proposed balanced budget for fiscal year 2017-18 is 6.1 percent larger than last year’s budget. When we submitted theMarch budget proposal, there were many revenue and expense items that were unknown at the time. Many of those items are now known. While many of the significant changes are explained below, I would like to highlight a few items.

EXPENDITURES

The largest expenditure change since March was for salaries and wages related to the collective bargaining unit agreements. While all eight bargaining unit agreements end on June 30, 2017, we have only received arbitration awards for five of the bargaining units. We used the awards we received to estimate the other three bargaining units. These wage increases are reflected in the Provision for Compensation Adjustment for each fund.

Another area of increase was in health benefits that were expected to increase by 6%, but the actual increase is now 10%. This increase was offset by a reduction in our expected payments for retirement benefits. The rates passed by the state legislature were slightly lower than anticipated in the March budget.

In addition, the funding for some items have been partially restored, such as Fire overtime and the Council contingency funds. In addition, some much needed equipment was added to the budget. The budget includes $600,000 to replace some of our aging police vehicles that were purchased in 2008. Also included is $600,000 for the bus system to ensure that we can meet riders” needs.

REVENUE

The Transient Accommodations Tax (TAT) was reduced by the state legislature. This put an additional strain on our budget. In addition, our projection for fund balance is lower than our estimate for the March submittal. This also created a need for additional revenue.

During April, the real property tax values were certified. This provided us with final numbers to aid in balancing and making decisions about the budget. While the real property tax values did indeed increase, this did not provide enough real property tax revenue to balance the budget.

IMPACT

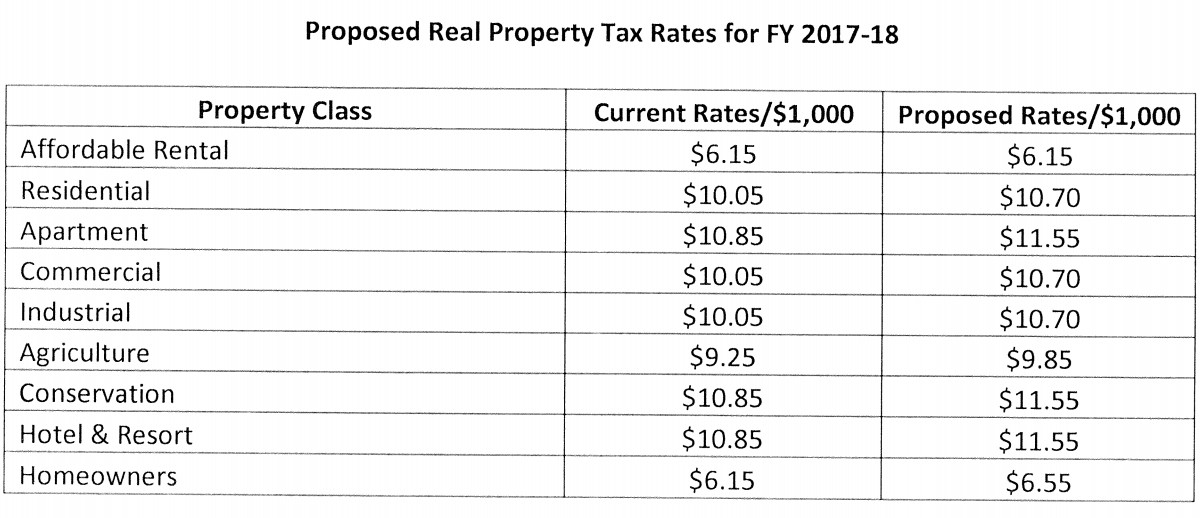

After all of the above expenditure and revenue changes, an additional $21.5 million in revenues was needed to balance the general fund budget. We looked at many forms of revenue increases, including looking at our real property tax rates and other related options. After careful consideration, it is our proposal to increase the real property tax rates by approximately 6.5% on all classes except affordable rental, to protect those most at risk. See Exhibit A for our proposed real property tax rates.

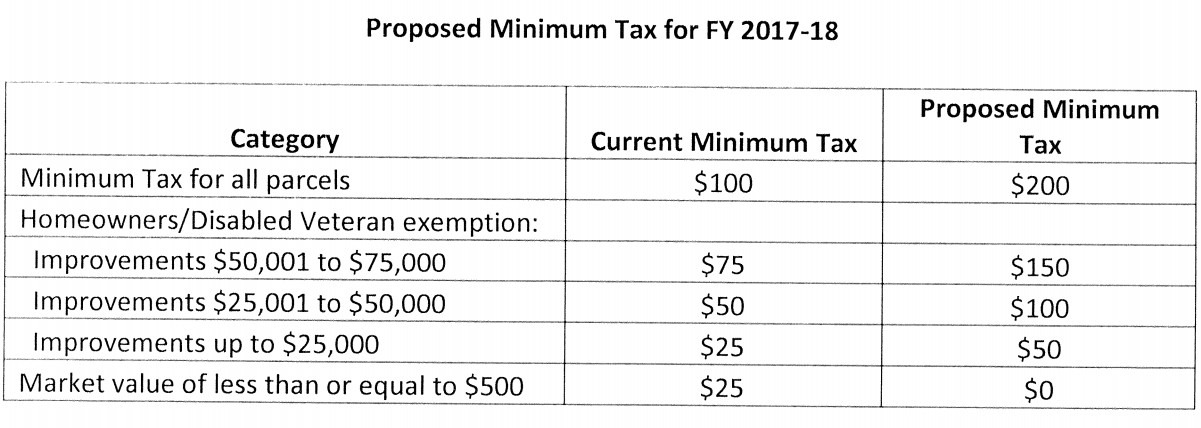

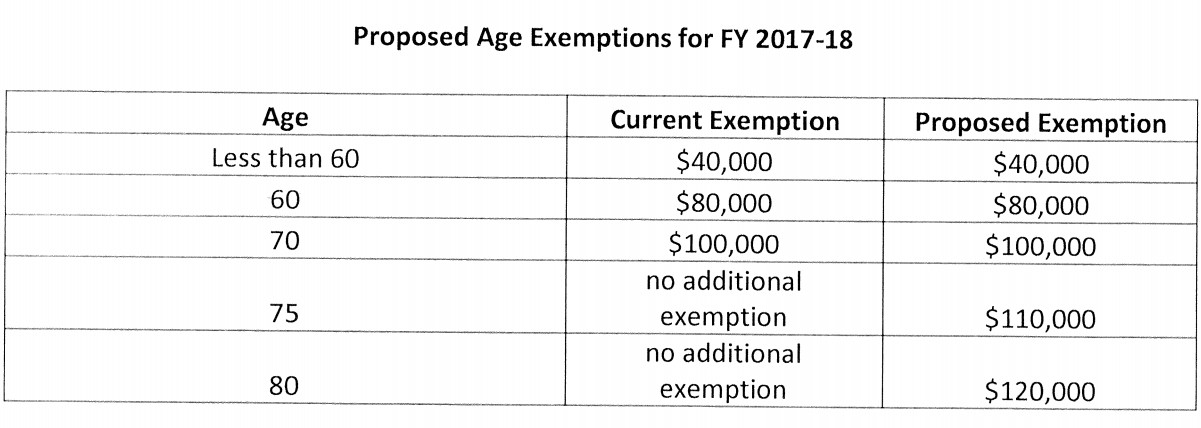

In addition, the minimum tax rates will also be changed to ensure that everyone is paying their fair share of real property taxes. To help offset these increases and to help protect those on fixed incomes, we are proposing to add two additional levels to our homeowner age exemptions. This would create an additional exemption at 75 and another one at age 80. More information on these proposals can be found on Exhibit A. Bills for both of these changes are being submitted with the budget.

We have also added a Real Property Tax Valuation Analyst to the budget to act as a compliance officer. The first project assigned to this person, will be to create a new classification for vacation rentals. While this will not generate additional revenue for this coming year, it will have an impact on the following year in fiscal year 2019.

In addition, we have reviewed the fuel taxes that go to help with road paving and our transit system in our Highway Fund. These taxes have not been increased since 1988. The condition of our roads continue to deteriorate at a rapid rate. It is time to take action to improve our roads and transit system. The Highway Fund has experienced two years of significant declines in the franchise tax revenue. Along with rising costs for roads, traffic and transit, the fund can no longer operate effectively without an increase in revenue. We are proposing an increase in fuel tax rates to be staggered in over a three year period. The proposed fuel tax rate increases are attached as Exhibit

B. We are submitting legislation with the budget to effect these rate changes.

Significant Changes to March 1, 2017 Revenue Estimates

General Fund

- Real Property Tax – revenue projections have increased by approximately $21.5 million primarily due to the proposed real property tax rate increases in almost all classes. In addition, the estimated revenue includes increases to the minimum real property taxes, as well as, the addition of two new age exemption categories for when homeowners reach 75 and 80 years of age.

- State Grants-In-Aid (TAT) – this revenue item decreased by $1.86 million due to the change in the amount of revenue allocated to the counties by the State.

- Fund Balance from Previous Year – our projected fund balance, or the carryover from the current fiscal year, was decreased by approximately $2.4 million due to revised projections.

Highway Fund

- Fuel Tax – revenue projections have been increased by approximately $414,000 to reflect our revised estimate. This increase does not include the proposed fuel tax rate increase. The expected revenue from the rate increase will be included via budget amendment later in the fiscal year.

Sewer Fund

- Transfer from General Fund – revenue projections have been increased by approximately $370,000 to help cover the increased costs due to collective bargaining and other cost adjustments.

Solid Waste Fund

- Transfer from General Fund – revenue projections have been increased by approximately $853,000 to help cover the costs of organics and other increased costs due to collective bargaining and other cost adjustments.

Housing Fund

- Transfer from General Fund – revenue projections have been increased by approximately $330,000 to help cover the increased costs due to collective bargaining and other cost adjustments.

Significant Changes to March 1, 2017 Expenditure Estimates

General Fund

- Legislative-Contingency Relief – $675,000 was included to help fund district needs.

- Police – funding for equipment was increased by $600,000 to replace some of the blue and white police vehicles that were purchased in 2008.

- Fire – funding for salaries and wages was increased by $1.9 million to cover all contractual overtime.

- Mass Transit – funding for equipment and maintenance was increased by $600,000 to help ensure that enough buses are available to operate our transit system.

- Transfers to Other Funds – funding was increased by approximately $2.1 million to cover additional costs for some of the special funds, including about $853,000 to the Solid Waste Fund to help cover the cost of organics and the increases for collective bargaining. The amount to the Public Access, Open Space and Natural Resources Preservation Fund increased by about $426,000 to cover the required 2% transfer to the fund relating to the real property tax revenue increase. There were also increases to some of the other special funds related to the increases for collective bargaining.

- Transfer to Debt Service – funding was increased by a total of $500,000 to reflect the revised debt service amount for the new bonds to be issued.

- Health Benefits – funding was increased by $500,000 to reflect the expected increase in the employer’s share of the medical premiums.

- Retirement Benefits – funding was reduced by $1 million to reflect our estimated contribution based on the rates adopted by the legislature, which were lower than expected.

- Provision for Compensation Adjustment – funding of approximately $8.3 million was included for collective bargaining increases for all bargaining units.

Highway Fund

- Provision for Compensation Adjustment – funding of approximately $393,000 was included for collective bargaining increases for employees of the Highway Fund.

Sewer Fund

- Provision for Compensation Adjustment – funding of approximately $180,000 was included for collective bargaining increases for employees of the Sewer Fund.

Solid Waste Fund

- Solid Waste – funding of approximately $535,000 was added to cover the cost of the organics program based on the revised contract amount.

- Provision for Compensation Adjustment – funding of approximately $340,000 was included for collective bargaining increases for employees of the Solid Waste Fund.

Housing Fund

- Provision for Compensation Adjustment – funding of approximately $150,000 was included for collective bargaining increases for employees of the Housing Fund.

Conclusion

This proposed budget represents our departments” best efforts to meet the needs of our residents in a timely and fiscally responsible fashion, while continuing to maintain the level of services our residents deserve. As our economy continues its gradual recovery, we are committed to continuing investment in infrastructure, transportation, public safety, and creating safer and healthier communities.

These investments are critical to the future of our Hawai‘i Island. We look forward to working closely with the Hawai‘i County Council to provide responsive and timely government service.

Aloha,

Mayor Harry Kim

by Big Island Video News5:36 pm

on at

STORY SUMMARY

HILO - Increases are being sought for property taxes as well as fuel taxes, according to a letter from Mayor Harry Kim.